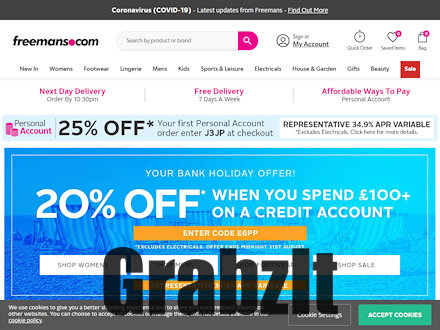

Freemans Catalogue Website

Freemans is in the top ten of the most visited fashion web sites in the UK. It no wonder when you take a look at the great fashion brands on offer; Laura Scott, Evisu, Joe Browns, Morgan, Nike, Playboy, Police, Roxy, Ted Baker and Yves Saint Laurent.

It has over 45,000 items for you and your home, including the lastest fashion and must have Gizzmos all delivered

FREE direct to your door.

Freemans offer various way to pay and by spreading the cost so you can buy

everything you want now and pay later with 12 months to pay with no interest (subject to status and eligibility criteria).

Representative 34.9% APR Variable.

Use the "Quick order" facility, this makes ordering online even quicker and cheaper than using the phone!

At Freemans you'll find over 45,000 products online including thousands of high street and exclusive brands so you can spoil your family, update your home and treat yourself! From the latest trends and styles to must-have gadgets and electricals there's so much to choose from!

The best serviceDid you know, Freemans has been established for over 100 years? We know a thing or two about home shopping, and Freemans is a name you can trust. What's more, we always go above and beyond to offer the best service we can, with FREE delivery and a dedicated UK call centre, open 7 days a week. Fabulous!

The best qualityWe are committed to quality here at Freemans and we want our customers to be delighted with each and every purchase. That's why we offer our 14 day home approval policy, so you can make sure you're completely happy with your order before you pay.

A handy guide to UK Catalogues with Credit.

Here is our handy guide to shopping from catalogues with credit, plus we have listed the most popular catalogues offering the best credit deals below.

What are the advantages of shopping from Catalogues with Credit?

The major advantage of shopping from a catalogue that offers a credit facility is that you can buy an item now and then spread the cost over a time period that suits you. This can be particularly beneficial if you are purchasing a high ticket item such as a TV, where paying a small monthly charge over the lifetime of the TV is preferable to paying the full amount at the time of purchase.

Are there any disadvantages in using Catalogue Credit?

Like any other credit facility, those offered by catalogue retailers charge interest on the amount of credit they give you. This means that by the time you have finished paying for the items purchased, you will have paid more than the original purchase price.

For example, a catalogue may offer a Samsung Smart TV at £1049. Rather than pay the full amount, they may offer a payment plan at just £10.51 per week for 3 years. This means that after 3 years you will have paid £1,639.42 for the TV.

This may seem a large increase on the original purchase price but TVs typically last more than five years and the catalogue retailer by providing credit has enabled you to pay for it in low weekly payments over three years.

However, if you do sign up to a credit agreement with a catalogue, you must keep up with the payments. A catalogue retailer will pass details of any non-payment on to credit reference agencies and this will affect your ability to get further credit in the future.

What is Interest Free Credit?

Some catalogues offer an Interest Free Credit facility. What this means is that you can split the cost of a purchase over a set number of weeks without any interest being charged.

For example, a coat may be priced in the catalogue at £100 with the option to buy it on Interest Free Credit at £5 per week for 20 weeks.

So as long as the amount owed has been paid in full by the end of the agreed period, then no interest is charged i.e. the original price the item was purchased for is the total amount spent after all instalments have been paid. However, if all payments have not been made in the agreed time period then the catalogue retailer will begin to charge interest on the remaining balance.

What is Buy Now Pay Later?

Another payment facility often on offer in a catalogue is Buy Now Pay Later. Typically this allows you to make a purchase today and then pay nothing for a specified time period e.g. 6 months. After the agreed time period, you can then either pay the balance in full and be charged no interest or you can begin to make monthly payments to clear the balance but this will incur interest. The interest charged will be for the time period where nothing was paid plus any subsequent time period until the balance is cleared.

This is a useful way of buying a distress purchase such as a new washing machine but requires discipline to store away an amount of money each month so as to pay the balance in full at the end of the agreed term.

For example a washing machine may be offered in a catalogue at £240 on 12 months Buy Now Pay Later. This means that if you put away just £20 a month, you can have the washing machine now and pay the full balance at the end of 12 months without paying any interest.

How much Credit will a Catalogue give?

The amount of credit a catalogue will give to a person depends upon their credit rating. Typically the better the credit rating, the more credit will be extended.

Catalogue retailers often have a tiered APR (Annual Percentage Rate) system. Put simply, the rate at which interest is added to your balance is determined by your credit rating.

If managed properly, catalogue shopping with a credit facility can be a good way of improving your credit rating by ensuring all payments are made on time and accordance with the credit agreement.